Top CE Training for Insurance Agents

Join us on January 29, 2025, for 3 hours of FREE CE training!

CE Credits for Insurance Agents

At LeClair, we understand how crucial it is to stay current with your insurance training and skillset. That’s why we will be offering 15 CE credits throughout 2025. Get started early this year with 3 credits in January.

9:00-10:00 AM

Join us for an enlightening hour on the Affordable Care Act. Learn how it impacts those under 65 and how to navigate its complexities from Jerid Bass.

10:15-11:15 AM

Join Harley Gordon as he discusses the evolving landscape of Medicare supplements. Gain insights that will empower your practice and enhance client relationships.

11:30 AM-12:30 PM

Join us for an informative session on preparing clients for extended care. Gain valuable insights that will enhance your ability to support clients in their long-term planning.

CE credit is not available for watching the recording.

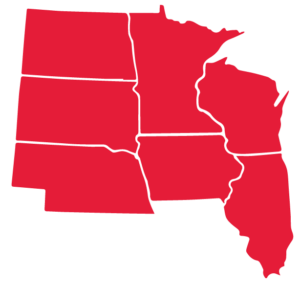

We’re offering three one-hour CE webinars to agents in Minnesota, Wisconsin, Iowa, Illinois, Nebraska, North and South Dakota.

Session 1: Affordable Care Act 101

Jerid Bass

Since the rollout of the Affordable Care Act in 2010, the market for individual and family healthcare policies has steadily grown. This course provides a firm foundational understanding of the products available on state and federal marketplaces as well as the end-to-end member experience: enrollment subsidies, medal levels, cost sharing, premium payment grace periods, and more.

1 CE credit

Session 2: The Future of the Medicare Supplement Professional

Harley Gordon

This CE session with Harley Gordon highlights the need for a shift in Medicare Supplement sales and marketing strategies, moving beyond traditional approaches. Sales professionals are encouraged to build on their trusted relationships to introduce advice-driven solutions that impact a client’s overall wellbeing, including their family and financial portfolio. By formalizing these approaches, the presentation equips professionals with strategies to capitalize on digital opportunities, elevate client relationships, and redefine how Medicare Supplement solutions are positioned.

1 CE credit

Session 3: Helping Clients Prepare for Extended Care

Rob Johnson

It’s not always easy to talk about needing long-term care with loved ones, our goal is to help you navigate through this difficult conversation. This course will educate you on effective long-term care (LTC) planning to support clients’ retirement goals. The course covers LTC options, funding strategies, and how to integrate LTC into a financial plan while positively impacting portfolios and legacies. You will learn to navigate sensitive conversations, address client biases, and explore case studies for practical application.

1 CE credit

Enhance your skills with expert-led training sessions. Find out about upcoming events at LeClair

by signing up for Engage! our weekly event email.

Introducing Our CE Presenters

Earn valuable and up-to-date insurance continuing education credits by learning from expert industry leaders who are at the forefront of the field. We are especially excited to announce that the legendary Harley Gordon, a recognized authority in the insurance industry, will be joining us for this exceptional opportunity. Don’t miss your chance to enhance your knowledge and skills with insights from such a prominent figure!

Sales Relationship Manager, Medica

Jerid Bass is responsible for managing and developing Medica’s Individual and Family Business products in four Midwestern states. With over eight years of experience at Medica, Jerid has successfully led product design, market research, and cross-functional team collaborations to enhance customer satisfaction and drive business growth. His expertise in strategy, regulatory compliance, and external partnerships has made him a trusted leader in delivering competitive health insurance solutions.

Attorney Harley Gordon is a leading expert on long-term care issues. As a founding member of the National Academy of Elder Law Attorneys, his insights have appeared in The Wall Street Journal, CBS Nightly News, and PBS Frontline’s documentary, “Who Pays for Mom and Dad?”

He frequently speaks at broker agencies and major financial institutions. His best-selling book, “The Conversation”, guides families on discussing the impacts of extended care.

Harley is also the driving force behind the Certified in Long-Term Care (CLTC) designation, a leader in professional education for extended care planning.

DBS Regional Vice President at Lincoln Financial

Rob Johnson is an accomplished sales leader with a proven track record of driving multi-million-dollar growth across long-term care and financial services industries. Currently serving as Sales Vice President at Lincoln Financial Group, he develops and executes strategic sales initiatives across a ten-state territory, achieving top performance in native territory sales multiple times. Rob’s expertise in client engagement, market penetration, and product education has solidified his reputation as a trusted advisor and dynamic leader in delivering impactful solutions.

If you have questions about CE credits, contact Sarah Korsch at sarah.korsch@leclairgroup.com

Only $149 for a 2 day ticket (Retail $199)